Somehow, over the years, the word “budget” became a bad word with negative connotations, when in reality, it’s a wonderful thing. Having a budget and sticking to it, allows you to have control over your money.

Before you can really start talking about saving money or spending it; you need to know how much money you really have to spend/save, which requires making a budget.

Be honest, how many times have you looked at your bank account and been surprised at the amount that was in there or say.

“man, where did the money go?”

If you’re asking yourself that question, you really need to make a budget.

I get that it’s scary to confront your own spending habits. But if you don’t, you aren’t going to improve your financial situation and just blindly saving money isn’t going to do what you need it to do.

You’re welcome to have a glass of wine if you feel like this is going to be really stressful, but you should still do it.

If you are someone who prefers to do this sort of thing electronically, there are several websites and apps that you can access that will be helpful, such as Mint, YNAB, and EveryDollar. You can also doctor up an Excel spreadsheet if you’re super tech-savvy.

Personally, I prefer a notebook and a pen. There’s something about writing it down that makes me feel more accountable.

But by all means, it’s more about knowing about your money than the method you use to get there.

When you are first starting in this, it’s better to keep it simple. You need to know how much money you have coming in and how much money you have going out. It’s also best to go through your past month transactions on your bank account when you’re creating your new budget. So much of the time we’re spending money without realizing it. Now is the time to be honest about how many times you’ve been to Starbucks or how often you pick up dinner or stop at the grocery store for a couple of things throughout the week.

And if you’re married and you and your spouse share finances, you and your spouse should really do this together. This is not a time to keep secrets.

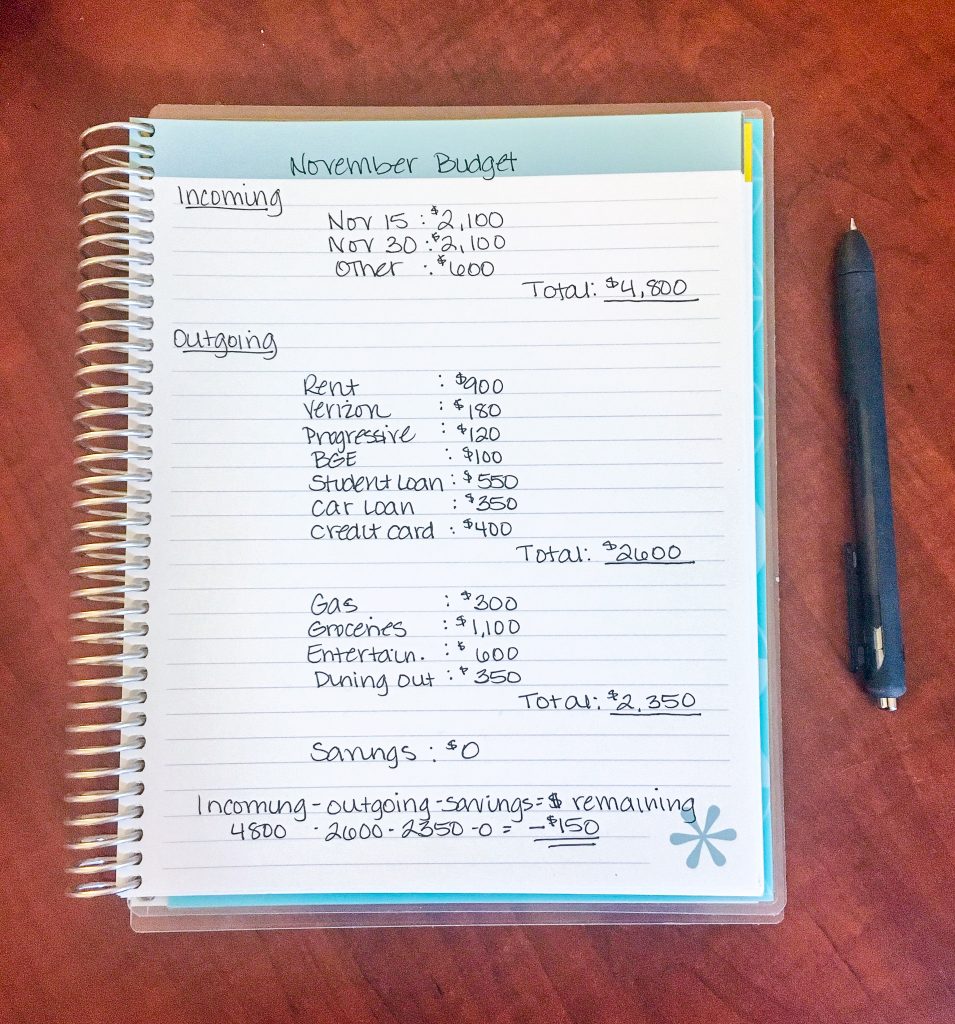

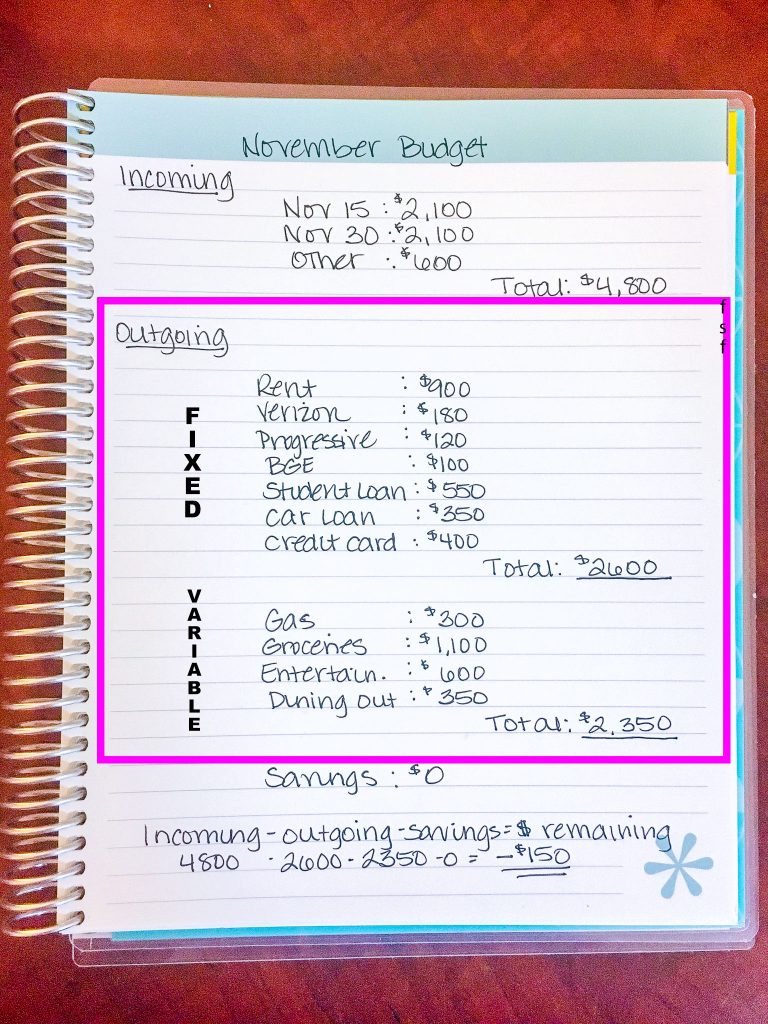

This is the basic set-up that I started with when I started budgeting:

Obviously, this is not my exact budget. The categories are mine, but the numbers have been altered for privacy purposes.

But, as you can see this is basic. My actual budget spread now has gotten quite a bit more complex as I’ve created goals for my finances and have things to save for and pay off, etc. But to share all of that would likely be overwhelming to most of you and right now it’s more important to just get a grip on your finances.

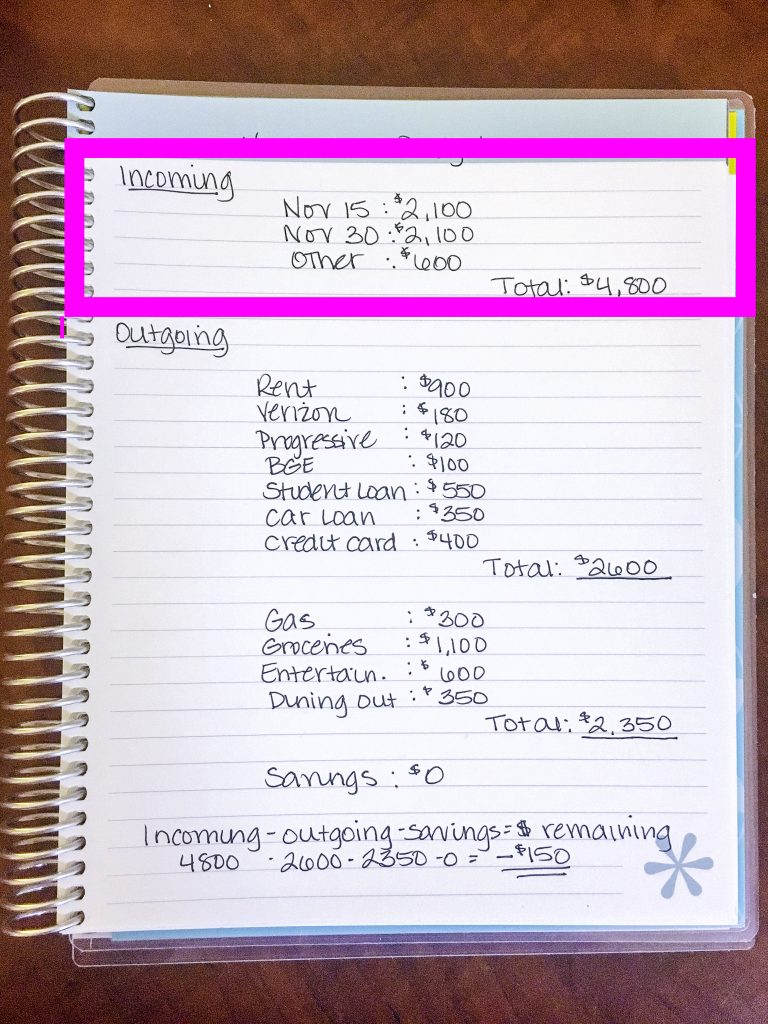

As you can see; there is a place for income (incoming money) and spending (outgoing). I get paid twice a month (no matter how many weeks are in a month), which is why I have dates like that; if you get paid every other week or weekly, yours could look differently. I also have some extra income from other areas that I add in there (we’ll talk about those later) because it’s just as important as my actual paycheck.

Then there is a place for outgoing. I divide my outgoing into two parts: fixed expenses and variable expenses. The fixed expenses are your mortgage/rent, utilities, student loans, car loans, etc. Basically the stuff that is relatively the same amount each month and that you pay each month without fail.

Variable expenses are those ones that can fluctuate, like groceries, gas, entertainment, dining out, travel, etc. Those typical happen throughout a month but some aren’t necessary and none of them typically stay the same from month-to-month.

You should also track savings; if you are saving. Again, you need to know where all of your money is going, even when it’s for something good like saving.

Once you have the total amount of your income, you subtract all of these outgoing expenses to see how much money you have left. You can see, this person’s budget…….there is no money left over…and they’re actually spending too much money and not saving any. Sadly, this is a bit more common than one would expect.

It’s easy to look at this and say, “oh well just cut out the dining out”, and while I agree, there’s probably also a lot of other places where cutbacks can be made.

If this is a household of 2 or 3, is $1100 a month for groceries really necessary? Is $600 for entertainment necessary? Are you overpaying on your utilities? Do you need to focus on paying off your credit card so you can free up that $400 a month for savings?

The answer is probably a resounding “yes” to all of these, but how do you do that? Saying it sounds really easy, but putting it into practice is where it becomes hard.

I know this can be hard; I had a hard time looking at all of this when I started. But when I took control over my spending and started to do something about it, there was a sense of freedom and control, all at the same time. I finally had control over what I was doing financially which eventually led me to feel like I have the freedom that my money is there when I need it to be and I don’t feel like I’m living beyond my means.

If any of this was eye-opening for you then this series will likely be really helpful for you, especially with the holidays coming up. There is no time better than the present to get all of your finances in order!