Did you know that, on average, households spend anywhere from $150-$350 a week on groceries? Yes, I said, “PER WEEK”, so that could be anywhere from $600 to nearly $1400 a month just on food.

And this is just counting groceries; not stopping for fast food or going to restaurants, picking up snacks at convenience stores, or getting those really fancy coffee’s in the morning. This also doesn’t take into account special diets like those of us that have to eat gluten-free (hey Celiac friends!) or have milk intolerances, food allergies/sensitivities/etc. Add all of that and you’re definitely headed closer to the $1400/month amount, especially if you also have a larger household.

For a lot of people, that amount spent on groceries rivals what the pay for their mortgage/rent every month, which is just astounding to me. I mean, I know people need to eat; it’s kind of one of those requirements of life, but it doesn’t always need to cost an arm and a leg.

I try everything that I can to keep our grocery budget reasonable because we are only two people. Granted, we’re two people that enjoy eating (and one of us has a gluten intolerance – yay me!) but it doesn’t mean we need to spend several hundred dollars a month unnecessarily.

Before my gluten-issues, we could easily do about $300/month on groceries; now we’re probably a little bit above $400 because it is harder to save on a lot of what it is I need to eat now, but it’s not impossible. But even still, that isn’t a bad amount for two people, I don’t think.

In order to keep our grocery bills reasonable, there are 7 strategies that I use to keep our budget in check.

I will also admit and preface this to say: Devon was not initially on board with all of this because some of it takes time, it means less satisfying random cravings that pop up out of nowhere (at times), etc. But, when he saw how much we were saving and when the realization of wanting to buy a home and the costs of a wedding, he eventually came to appreciate what I was doing. There are still some “I’m gonna let you handle that” from him when it comes to this sometimes, but I’ll take that over him dropping $200 unnecessarily at Giant on snacks.

1. Meal Plan

I am going to do a whole dedicated post on how I specifically do this, but it is so important to plan out your eating for the next week or two weeks so that you know what you’re getting from the grocery store. So much overspending comes from just shopping the aisles and saying “this looks good” or “this might work for lunch”. And then, if you’re me, you don’t wind up eating it and it just sits in your closet until it’s so old that you throw it away. So, now you wasted money and food. I’ve done that and it sucks.

I get it, this is something that can take some practice to get into the swing of. It also takes some time to really sit down and plan everything out. But the time you are spending here will save you money at the store and it will also save you time throughout the week because you don’t have to stare aimlessly in your pantry and wonder what to have for dinner.

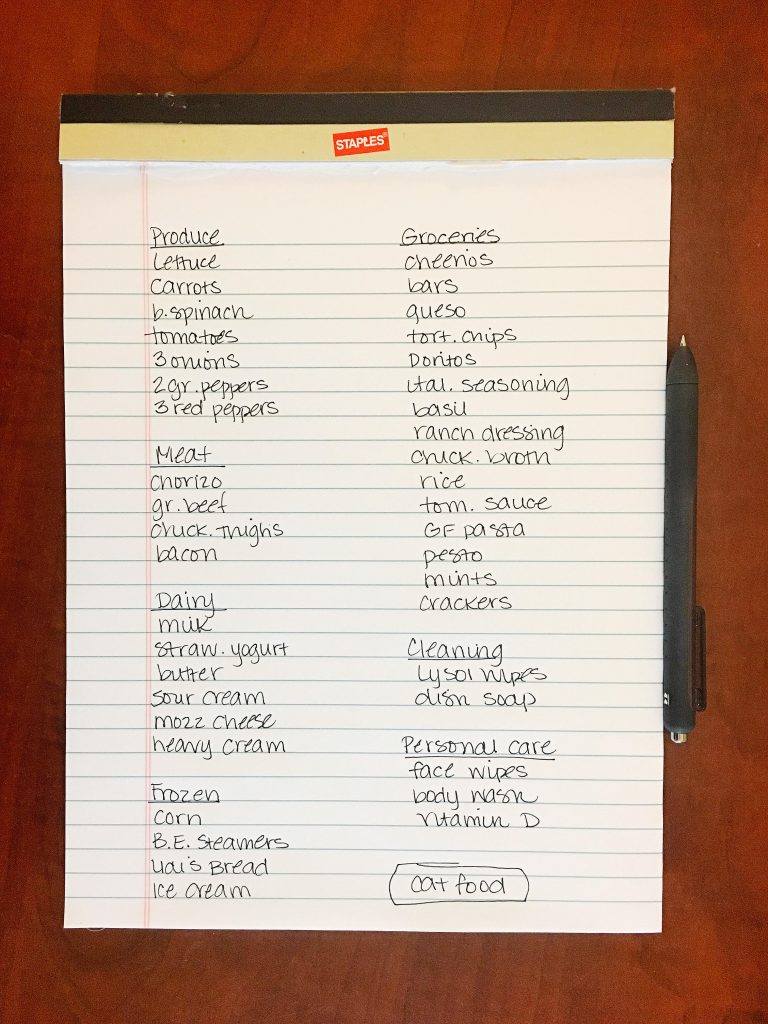

2. Make a list and stick to it

If you’re meal planning anyway, you should have a list done pretty easily from what you’re making. If you’re out of certain staples, write them down. Tell yourself that when you go to the store that you are only buying what is on your list. If it’s not on the list, leave it on the shelf. Impulse shopping can kill any budget. I can’t tell you how many times I’ve walked into Wegmans, saw something and been like, “oh…I want that”, but I don’t get it because I either look at my long list and don’t want to spend more, or I look at my meal plan and say, “there’s literally no time this week that I would be able to eat that”, and I put it down.

It also makes your shopping trip go that much faster because you’re just looking for things on your list instead of at all of the other things you aren’t there for. If you want to be as over-organized as I (sometimes) am, you can even arrange your grocery lists by category or by how your grocery store is laid out. I do by category and then I do the packaged stuff by aisle according to my usual route in the store, as you can see in the photo below. This way I get everything without having to take so many trips around my already huge grocery store. Because with my store, if I forget something and it’s on the other side of the store…I’m not going back for it.

3. Shop sales

Back in the day, most grocery stores had circulars or ads that told you what was on sale in any given week. While most of the stores around me don’t have them in print anymore, most still do on their website. When you are making your meal plan and shopping list, checking these out is a great idea. In many cases you can plan your meals out around sales, so you aren’t spending quite so much. There is almost always sales on items it’s hard to save for in other ways (like meat, produce, seafood), so it’s great to really keep an eye on out for these to save you quite a bit off your bill.

4. Shop multiple stores

This sounds daunting, I know and I respect that this isn’t feasible for everyone, but if it is, it is so worth it. I shop three stores (most weeks, because sometimes I can’t do all three either); Aldi, Target, and Wegmans. Each store has it’s own advantages. for instance, I typically go to Aldi for produce, meats, some gluten-free stuff and random pantry staples. Admittedly, I can be brand loyal for some things, but the things I’m not brand loyal usually wind up coming from Aldi. Aldi also has really good shredded cheese deals. In my store their usually right under $2 and the bags are bigger than the sizes you typically find in stores, so the value is amazing.

Target is good for their Cartwheel and sale prices, so I have a tendency to get quite a bit there as well. By the time I get to Wegmans, it’s usually just the few things that I either prefer Wegman’s brand for (like Wegman’s salad dressing is life) or the things I couldn’t get at either of the first two stores. If I don’t have time, I’ll usually skip going to Aldi just because it’s farther away and Target and Wegmans are across the street from each other near me.

5. Use coupons

Yes, those things your Mom and Grandma clipped from the Sunday paper. Those things. But, because we’re new-age and all, they aren’t just available in newspapers anymore. They are also available to print online, which is a lot easier for most people. You can go on sites, like Coupons.com, Smartsource, Everyday Saver, and RedPlum. Oftentimes, you can also find coupons on brand websites that you can print. Most internet coupons you can print two of, which is good if you find an item on sale, you can get more than one and stock up on it. If you want to access newspaper coupons but don’t want to get the newspaper (like me), you can use a coupon clipping service like klip2save.com that you pay around 0.08 per coupon and they mail them to you. It sounds weird, but I only get the coupons I actually want and will use and, for me, it winds up being around the same price as the Sunday paper and I don’t have to do any of the work of clipping anything.

6. Buy in bulk/stockpile

This is a really great thing to do, especially if you are someone who prefers certain brands of things that you use a lot of (like I love ALL Detergent, so when it goes on sale for 50% off or more, I usually buy 3 or 4 of them so I can have it on hand and not have to buy it again for awhile. If you are a family that goes through certain things quickly, a Sam’s Club/Costco membership may be beneficial. A lot of the time, warehouse clubs can be cheaper for pantry staples that a lot of homes use a lot, like pasta sauce, canned veggies, and produce.

If you do use coupons, this is an even better thing to do because you can use a coupon on each of the items and save a bunch. Like I mentioned I like ALL detergent; I can usually find it on sale for $3.99 (regular price is usually $5.99-6.99) and there is often a $1 off coupon, which makes each bottle $2.99. So using the sale and coupons, if I were to buy 3, would be around $9 for all three when one bottle normally retails for almost $7. Definitely worth stocking up on items like that when you can.

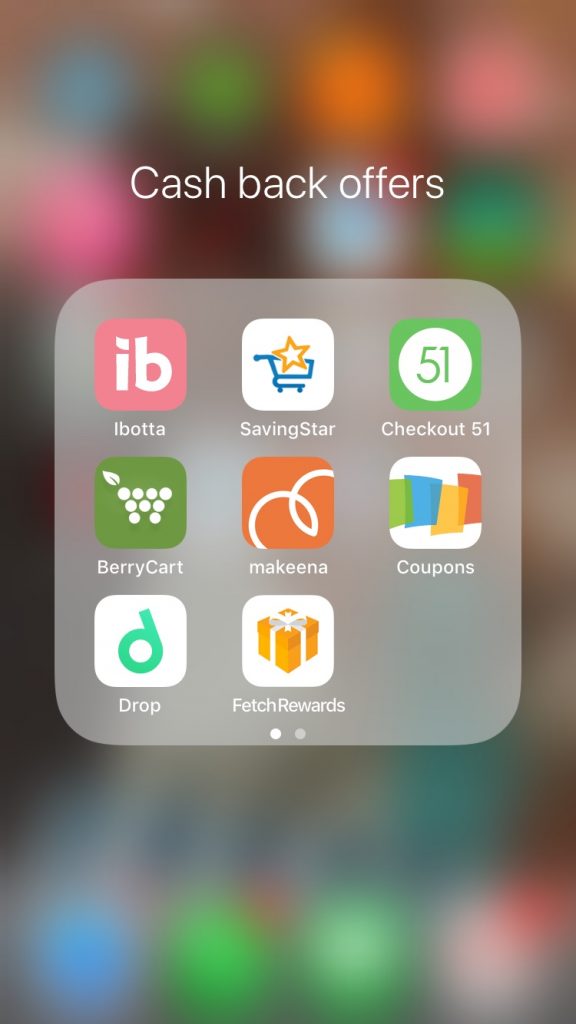

7. Use cash-back apps

There are so many apps now that offer money back or rebates for items that you have already purchased. All you typically have to do is take a picture of your receipt (and occasionally the items themselves) and upload it to the app on your phone. If you get lucky, which happens on occasion, sometimes you can get multiple cash back rebates on the same item when you use multiple apps. These apps also often have rebates on fresh produce and meats, so it’s a great way to save on things that you can’t always easily get deals or sales on.

I typically do these when I get home. More often than not, I don’t have to scan the item I purchased; just the receipt. Each app varies on their threshold for cashing out (for some you have to accumulate $20 before you can collect funds), some you collect points that you can redeem for gift cards. If you use these regularly, the minimum threshold can be reached pretty easily.

There are so many of these apps now, but some of my favorite, and easiest to use, are Ibotta, Checkout51, SavingStar, Coupons.com (similar to the online coupon site, but it provides rebates paid through PayPal after the item is purchased), Makenna, BerryCart (great for Gluten-free, vegan, and other special dietary needs), Drop (use code: 0ug9m to earn an extra $5 when signing up), and Fetch Rewards (use code UJ5QD to get a bonus when you sign up). Each app can take about 5-10 minutes to set up but I can tell you I have saved hundreds on each app, easily; it’s definitely worth the time. I even keep them in their own designated folder on my phone to keep them easily accessible.

***

I get it, all of this takes time; I’m not pretending it doesn’t, but if you are serious about saving, it will be time well spent.