As promised in my initial No Spend Post – I wanted to share the results of our month of trying to curb our spending from the holiday season.

Like I stated in the initial post, this month was meant to be more of a financial reset for us than anything else. With the holidays, like most people, we spent a bit more than we would have normally. There were gifts we purchased, there were also some things we purchased for the house, for our nursery, and things around the house that needed to be replaced/upgraded. While we typically budget for this stuff throughout the year, it can still put us in a habit of spending money a bit more freely than we normally would. So, doing this reset can really put us back into our normal money-spending habits and ensure we are staying within our budget every month.

We also wanted to focus on reigning in our food/takeout budget. We were really getting into a bad habit of eating out or getting takeout a bit more often than we needed to. That really happened, especially, in the first trimester of my pregnancy when I was super tired all the time, and we just never fully stopped doing it when my energy returned, so this was also for us to get back to “normal dinners” at home.

Overall, I would say we did really well. Were we perfect? No. But, I very much believe in progress over perfection. There were a couple of times where we either ordered in when we didn’t need to or spent money when we could have avoided it, but I do think, more often than not, we made more conscious decisions in terms of our spending, which was our biggest goal.

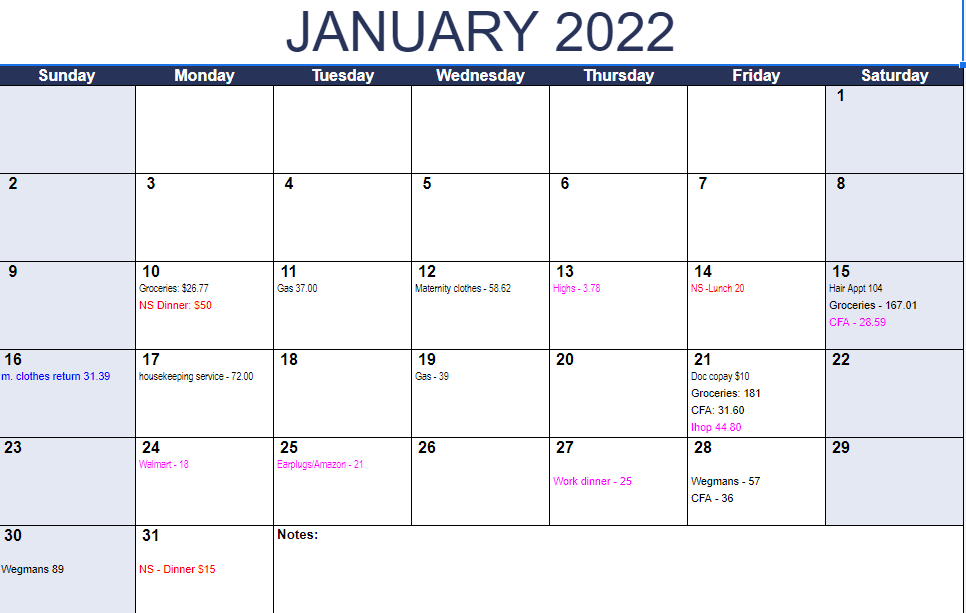

In order to keep us accountable, I did make a calendar for us to track our spending that wasn’t typically budgeted. So, there were no bills on here, we didn’t put transfers into savings accounts on there or anything like that. It was just for the times that we grabbed our debit card to make a purchase somewhere.

So here is January:

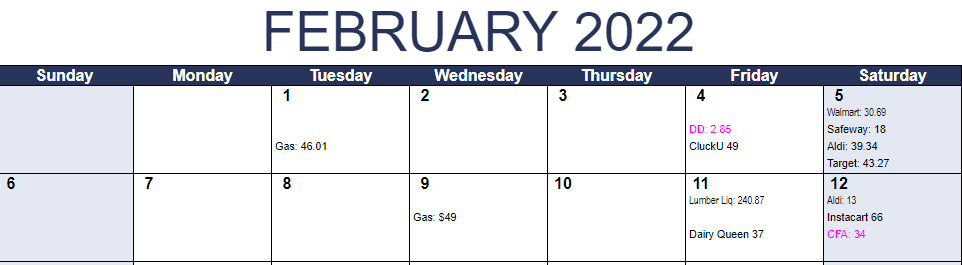

And here is February (what we strictly tracked of it):

Any amount that is in black is a “normal” or “budgeted” expense; meaning we anticipate those but they are either random expenses or things like the grocery store where the actual amount changes weekly.

Like, you can see my hair appointment is in black, but that’s because that appointment had been planned for – maybe not down to the actual dollar amount, but we knew it was coming. Dinner out on Friday is also in black, because that is something we do every week, and like we said, we weren’t giving that up.

You’ll see a few things in pink – those were unplanned, mostly it still went to eating out in some capacity. Again, we wanted progress over perfection and I think that’s still better than what we had been doing.

I did place one thing in blue because that was a return on a purchase that I made that month, so that money was coming back to us.

There are also a few things in red because those were times I was tempted to spend and didn’t, so I wanted to highlight that. I didn’t highlight every time I had that thought, but especially when it came to me deciding to make lunch/dinner instead of ordering out I wanted to put that there to show that we’re still tempted but there are times when we make those better choices and eat at home like we should.

For some people, this is still a lot and I completely respect that.

Like I said in the initial post, cutting back on your spending habits looks different for everyone and for every family.

For us, we were able to put an additional $500 into our savings than we would have been able to the month prior which made all of this completely worth it for us. In fact, that $500 we wound up pulling back out a couple weeks later to pay for the nursery room floor and we had that money (without having to touch what was there previously) because of this and to me, that is absolutely wonderful.

We aren’t necessarily still doing this right now, but we usually do this a few times of the year, we have a month where we really clamp down on our spending and put extra into savings. We have been buying a bit more than normal because we are getting our nursery together, but a lot of that is done, so we may go ahead and do another one of these in April to get ready for our little one who is coming in June.

Even just doing these once a quarter can be so beneficial, not just financially, but also just for helping to reset your mindset in spending money. We all get into habits of spending, especially if it makes our life easier, but it’s also so important to remember that life happens, you never know when you may need a little extra money for a home repair or a car repair, etc and it’s so much more comforting to know you have that money set aside and that it won’t cause financial hardship in order to make those repairs.

Like I said, I know we may do this differently than some others, but I’m hoping that seeing our journey with it is helpful and maybe inspires you to try it for you and your family!