I feel like between the months of November and December we spend so much money in our house. Obviously, part of it is because we’re buying gifts, but the sales are also always so good that we use that time to replace things around the house or upgrade/update things/spaces that are showing wear.

While we always prepare ourselves financially for it and we don’t buy things we can’t afford, it still always feels like we need to do a reset come January to reign in our spending habits. I know myself and I know that if I don’t take steps to reign myself in, I could easily continue my “excessive” spending without a second thought.

And for those who may be new around here: Devon and I are both high school educators.

We’re not about that “excessive spending” life.

So, for the most part, every January I do a “No Spend Challenge” of some sort. I always kind of change up the “rules” or my exact focus, but the intent is always the same — not spending money on things that aren’t essential for us. I say, “essential for us” because everyone and every household has a little bit of a different idea of what is considered essential.

Our essential things include:

Mortgage/HOA Fees

Bills/Utilities

Loan Payments (i.e. Car, student)

Groceries/Personal Care needs

Gas

Takeout Fridays

Nursery Items (incl. carpeting)

Maternity clothes/needs

House Cleaning

Now, I know that for some people some of the things on that list wouldn’t be considered essential; like “takeout Fridays”. And I will admit, is it the MOST essential, no, but for us it’s a nice reprieve & comfort at the end of the week. It’s the same with paying someone to help clean the house – is it MOST essential, no, but it has done wonders for me which makes it something I’ll happily continue to pay for.

Obviously, also being pregnant would add another “essential” piece for us as we are beginning work on the nursery and getting ready for the baby. We know how long shipping is for so many things and we want to make sure that the room is ready, so that means buying things early. While I don’t intend on purchasing a lot of maternity clothes, I also know that I am at the point where my clothes are starting to get too tight for me to wear which means I may have to make a purchase here or there to make sure I have comfortable things to wear.

But what you don’t see here are random and impulsive Amazon purchases, scoping out the cute things at HomeGoods or TJ Maxx, ordering takeout on other nights just because I’m feeling lazy and don’t want to eat what we have here. All of those things are where we have a tendency to overspend or spend unnecessarily. And that is mostly what we are trying to reign in here.

For me, No Spend times is kind of like “dieting”. If you are just eating 1200 calories a day of boiled chicken and boring vegetables; you’re not likely to sustain it. But if you’re eating 1800 calories a day with a good mix of delicious proteins and veggies and starches, and allow yourself to have a decadent dessert from time to time; you’re a lot more likely to sustain that long-term. (FTR, this is also why I managed to lose about 20 pounds after working with a realistic fitness coach as opposed to trying to cut out all the things when I was trying to lose weight alone.). I know that cutting out EVERYTHING feels like deprivation to me and once I feel deprived, I rebel which defeats the purpose of that I was set out to do.

My ultimate goal is to do a No Spend Month, but for me, that always feels like a lot, so I break it down into weekly goals, sometimes even just a day-by-day goals. Making the time frames smaller makes it easier for me to stick with the ultimate goal, which is to change my overall spending habits.

We are starting our No Spend today. Why today instead of 10 days ago when the month started? No reason, really. We haven’t really done a whole lot of spending the past week or so, but we also didn’t really leave the house because of snow and whatnot, either. Both Devon and I being fully back to work and out and doing things — that’s when the likelihood of us over-spending settles in.

How do we do this?

The first thing we always do before going on a No Spend is we take a look at our budget over the past couple of months and see where we need to cut back. I can go more into how we budget in another blog post, if anyone is interested, but we are detailed enough in it that we can see where we overspent throughout the month.

Then we also look at what is going on for that month; is there some sort of special event that will wind up being an expense for us? Is there something in the house that we may need to take care of, or anything that may be most beneficial for us to replace this month. Like I’ve mentioned we are planning to rip out the carpet the nursery and put in new floors – that is something we’re working into our monthly budget.

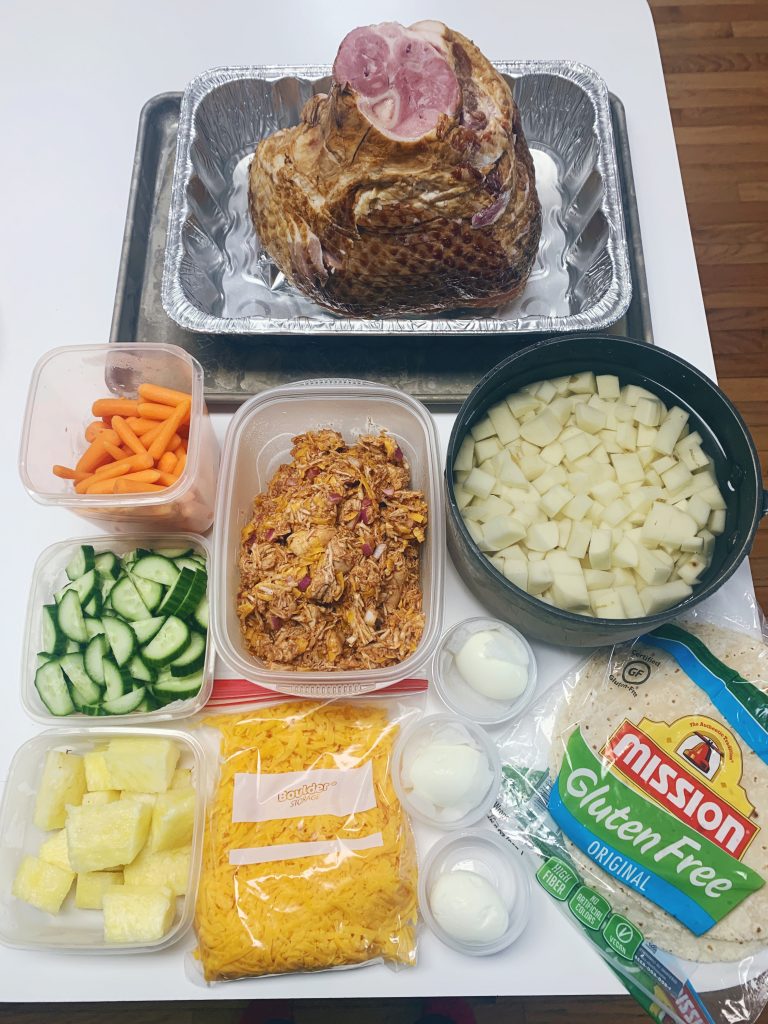

We also take inventory of our pantry, fridge, and deep freezer to see what we have. I’m one of those people who can easily spend more than necessary at the grocery store because I like to walk around and see what’s new and try out new things. But, is a lot of that necessary? Not usually. So, a lot of this No Spend also comes down to getting my meal planning back on track and making sure that we have everything we need for dinners/lunches as well as making sure I’m doing meal prep on Sundays.

It becomes really easy for me, during the week, to go “I don’t feel like making this for dinner”, but if I already have part of it prepped or ready to go, I feel more obligated to go ahead and make it. Plus it’s easier to make dinner if part of it was already done for me. I can also go more into my meal plan strategy in another post as well.

At the end of it all, No Spend Challenges are really about being intentional with your purchases – not buying things out of convenience when you have something already in your possession that works just as well. And that is really where we are focusing this month.

In order to keep us on track for this month, we’re using a simple daily spreadsheet. We will be tracking what we spent (and what it was on) as well as tracking things we didn’t spend money on. Because there will always be moments of temptation – like I wake up super lazy on morning and decide it would be easier to order lunch than pack one – but I don’t because it’s an unnecessary expense when I already prepped lunch for that day. So I want to track those things we didn’t spend money on (like the possible $15 I saved by not ordering Door Dash) and at the end of the month, we are going to put that money into our savings account – as well as likely a little extra.

I’m just using a simple calendar template that I could put into my Google Sheets (this way Devon and I can share it and add to it as need to). I put the expenses we have in Black and the times we didn’t spend money (but could have) in red. Since we are starting today (and haven’t spent anything yet) I just put something in there as an example.

If you want to join us in our No Spend, you can go online and find any template you like, or you could use a physical calendar to keep track if that is better for you. Since Devon and I are sharing this, I’m using an electronic version so neither of us has to find it.

This is a really great time of the year to look at doing a financial reset. If you haven’t started one yet and would like to join us, feel free to grab a calendar and track your expenses for the next 30 days. There is no rule that you have to start this on the first of any month – it’s really just about taking the time to get your financial situation under control and what better time to start than today!